That is why was applying the Credit Memo to the original invoice as a payment, however, I thought that the amount would show up in the P&L for the date of that payment.Only a payment on the invoice will record income as of the date of the payment. Yes, we are clearing Deferred Revenue with the credit memo each month.Correct, which is why I was applying the Credit Memo to the original invoice as a paymentĪre you clearing Deferred Revenue with the credit memo each month?.So no matter what you do outside the invoice, if you do not "pay" the invoice you do not record the income item in the invoice. Unpaid invoices in cash basis accounting are not yet income until paid. You created an Invoice, you must receive payment against the invoice or the invoice remains open. Then applying that same credit memo as a payment to the original invoice (which has an item linked to income account) to reduce the invoice balance.I was using the Credit Memo to reduce the Deferred Revenue

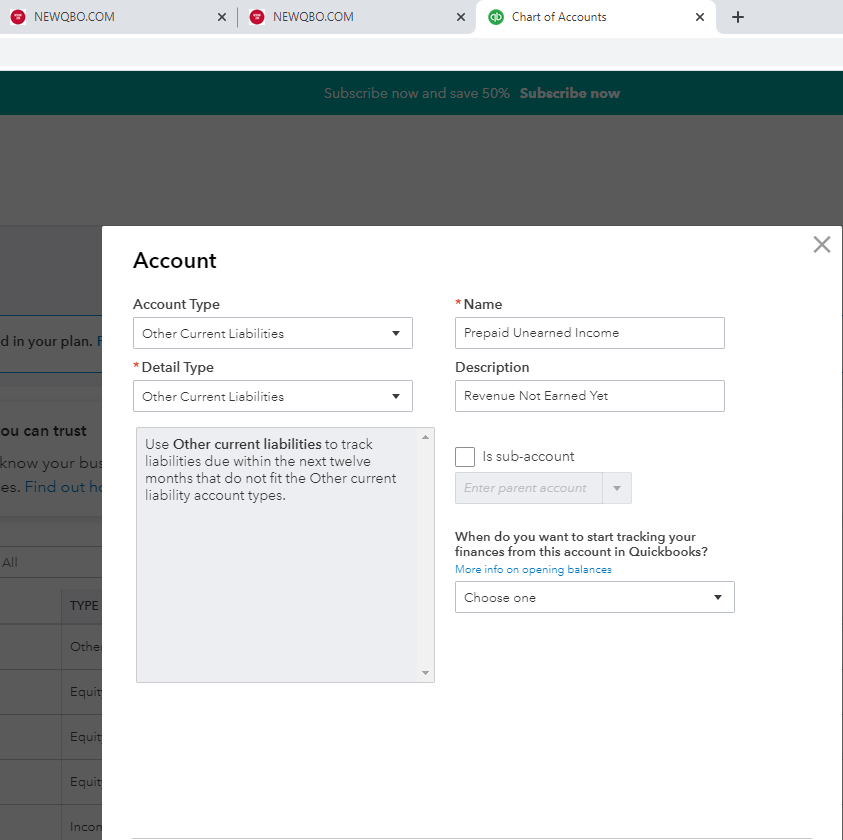

And it creates a negative AR balance, which s/be zero. " c/memo does not create revenue it reduces it. "As services are rendered monthly we do credit memo to the original invoice to realize the revenue. Correct, deferred revenue is set as a liability.So the linked income account of the Item is deferred revenue. When payment are received they are entered as sales receipt to deferred revenue. Thank you for the help it will definitely me get closer to fixing this. should record that much incomeĪre you looking at your P&L as cash basis or accrual? Technically by issuing invoices you are either accrual or can use a hybrid method allowed by the IRS Monthly go into the Invoice to receive payment (or Receive Payment button), apply just the monthly amount of the c.m.

#New to quickbooks 2015 tutorial deferred revenues full

The customer credit memo will be created for the full payment.

Go ahead and create the annual Invoice, Receive payment but do not select the invoice. You can Receive Payment with or without an Invoice. You can do that, receive payment from credit memo, right in the Invoice.Īlternately consider this. Then month by month create a progress invoice and apply appropriate amount of credit memo as a payment. Go ahead and receive $1200 in advance for first invoice of $100 (or no invoice until service is performed) and you will automatically create a customer credit of everything paid ahead. My recommendation is to use an Estimate and Progress Billing month by month. What does services monthly even mean when you have an annual invoice? Yes, you billed the customer in advance for a year's worth of services not yet performed, however you, as described, do not receive any money until the year is over? Where is your payment in this? Up front? THAT is a different animal altogether

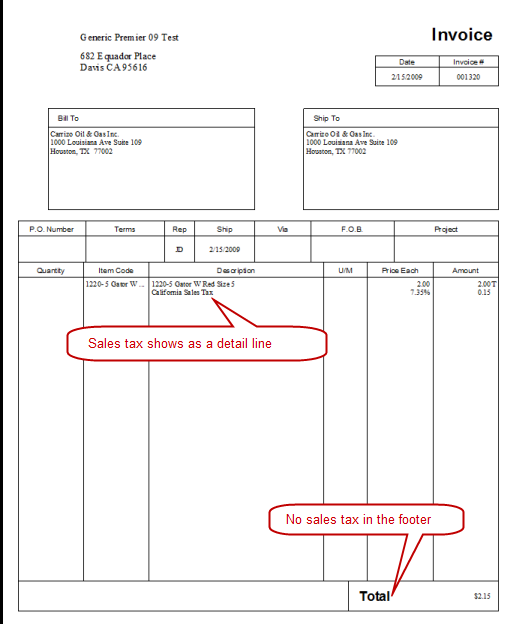

Doesn't show on P&L for credit memo date?Ĭorrect action by design, I believe, and are you clearing Deferred Revenue with the credit memo each month? Only a payment on the invoice will record income as of the date of the payment.

Services monthly we do credit memo to original Inv.

0 kommentar(er)

0 kommentar(er)